Rory Moore (pictured) has worked at Ekati, the first diamond mine in Canada’s Northwest Territories, on and off for years. He was part of the original crew that first developed the mine in the 1990s. In 2018, he rejoined what was then called Dominion Diamond. He then became its interim president in January 2020, and in November, he was appointed the full-time CEO of what is now called the Arctic Canadian Diamond Co.

Here, he talks with JCK about his view on the diamond market, how Arctic looks at Canadian cutting and Canadian-origin stones, and why Ekati might confound expectations and stay around for a while.

Can you bring us up to date on what’s happening with Ekati and its current ownership structure?

With the onset of COVID, the diamond market closed. We had a partnership with Rio Tinto in the Diavik mine, which is a neighboring mine. After COVID, we [initially] elected to put Ekati on care and maintenance, because we had $200 million worth of diamonds in inventory, but we couldn’t sell them. We didn’t want to burn through our cash reserves quickly. However, when Diavik did continue to operate, we were obliged to pay our 40% interest in the operating costs, and that would have very quickly have chewed up our cash reserves. So, we [filed] for CCAA [insolvency protection].

That triggered its sale process and the former owners, Washington, participated in that and ultimately withdrew their bid to buy the assets, and then the debt holders stepped in, represented by the three principal organizations: DDJ Capital, Brigade Capital, and Western Asset Management. The three of them stepped in and bought the assets and [provided us] with some additional cash to reopen the mine and get going again.

We restarted the mine in January last year, which is in the dead of the Arctic winter, so that was challenging. We had lots of startup problems, but ultimately now we have got the mine running at a steady state. Fortunately, we had some nice tailwinds from a strong rough diamond market last year, so prices were very robust and that really helped us with our restart. We met our revenue targets last year despite all the challenges.

You have said you want to extend the mine life. How do you plan to do that?

The best days of Ekati are behind us in terms of quality of ore bodies. During the early years, when BHP owned the mine, the ore bodies were very rich and very close to the central infrastructure at the mine, which is the process plant. So operating costs were very low, and revenue was very high. It was a highly profitable mine.

As time has gone on, those bodies have been mined out, and we are now mining lower-value ore bodies further away from the plant. Our main open pit, Sable, is 17 kilometers north of the process plant. It’s a lower-revenue ore body and there’s additional transportation and logistics involved in getting the ore from the open pit to the process plant. Then, to the south, we’ve got our Misery underground mine, which is a high-revenue ore body that has now gone underground, so it’s mining at a lower production rate. And that’s 25 kilometers south of the processing plant, so again, we’ve got to transport the ore to the plant.

What we faced going forward is, as these ore bodies come to their natural end, Stable in particular, they were not valuable enough to support conventional underground mining. And, so, what we’ve done is over the past four years—and this is what I’ve been working on—is looking at alternative, more creative ways to mine these ore bodies so we can still mine them profitably.

We’ve come up with a system, it’s called underwater remote mining. Essentially, we flood the pit, and after the open pit mining is completed, and we continue to mine it underwater, using specialized underwater surface mining machines that we’ve developed in conjunction with a company out of Holland called Royal IHC. We are very confident that it’s going to work, and the beauty of this method is that you only mine ore and not waste. So, with conventional mining, you have to mine a lot of waste. In fact, at Sable, there’s seven times more waste [being mined] than ore. If you remove all that waste mining, suddenly your costs are dramatically lower, and you’ve got a profitable mining operation again. That’s the way we are going into the future.

We have designed all the equipment, and we are going to construct the first of that equipment this year. Then, we’re going to do a big production trial in 2024. We’re building equipment this year, and then over 2023 and 2024, we’re gonna test that equipment and then implement it in 2024 for future mining at Sable, and then extend that to other ore bodies. The future of Ekati is underwater remote mining, which has not been done in this sort of setting at all in the past. We are spearheading some new innovative mining techniques.

Assuming that all comes to fruition, how long will that extend the mine life?

Initially, the first phase will take us to 2029. The other thing that we’re doing at the moment is developing a new conventional open-pit mine at the same time. That will take us to 2028. We also have the opportunity to extend mine life through underwater remote mining at Point Lake. That ore body has 50 million tons of kimberlite in it. So, if the underwater remote mining works, we’ll get an additional 10 years of mining out of Point Lake. Then, we have another ore body that was mined by BHP called Fox, and that has 40 million tons of kimberlite left in it. We’ve done studies to potentially develop it with underground conventional mining, and it doesn’t make the grade. So, we would look to mine that underwater as well, which would add another 10 years of mine life. So, essentially, we have decades of mine life extension, but we have to prove the system first.

You said you’re confident that will work.

Yes. I’m very confident. Components of the technology have been routinely used in other applications, in conventional dredging operations throughout the world. We are putting it all together in a system that hasn’t been used in this application. None of it is rocket science. It’s all proven technology.

The owners have been very supportive, and they have been very open to funding our development of [the underwater remote mining] method. We’ve got a stable operation now, and our immediate focus is to pay down the debt that we have, and we’ve already started that process this year. We had a good revenue year, and we’ve already paid down the debt very substantially.

There have been concerns raised about underwater mining from an environmental point of view. How do you respond to that?

In fact, this method is significantly more environmentally friendly than open-pit mining. That’s because, firstly, you don’t have any big waste dumps. So, all that footprint of the waste dumps interfering with caribou migration or changing the landscape, that goes away. You have a closed water system, so all the water that’s in the mine [goes to] a pond next door to the open-pit mine, where we’ll settle out the sedimentary material. It will be a closed system. So, no water that’s been disturbed or polluted in any way will get out into the secondary environment. It’s very much contained and has an incredibly small footprint.

The machine has been devised so that all the hydraulic fluids in the machine are biodegradable. I’d be lying to you if I said we’re not going to burst hydraulic hoses once in a while. We will have hydraulic oil spills, but [they will be] biodegradable hydraulic oils by design that will not contaminate the water in any meaningful way. So, the environmental impact is much lower, and that’s a positive for the project as well.

What has been the reaction from the local community to Ekati restarting?

Our northern partners are very relieved that we are back in production. We have a lot of training and career opportunities for people of the north. There was big relief that we did come through the CCAA process, that we’ve hired a whole lot of new people, and our training programs, apprenticeship programs, leadership programs are back in place. We’ve got partnerships with the local indigenous groups and communities. They’ve supported us very well, as has the government of Northwest Territories. It’s all pretty positive, after a tough period of 10 months not being in production

You no longer have 40% ownership in the Diavik mine, as Rio Tinto took it over. How does that affect you?

On a practical basis, it doesn’t impact us much, because we were essentially a passive partner in that. Rio Tinto operated that mine and we just participated in quarterly management committee meetings. It doesn’t impact our workforce in any way, as we had nobody working at Diavik.

What it does impact is the product mix that we take to the market. We used to have a big production out of Ekati, supplemented by a fairly significant production out of Diavik, which gave us higher carats and higher volumes to sell into the rough market and gave us more options for product mix for our clients. We’ve lost a bit of flexibility in accommodating our clients’ exact needs when it comes to the product mixes.

But the productions are fairly similar between Ekati and Diavik. So, the impact of that hasn’t been too significant. It’s more that we’ve just got a lower volume of diamonds to sell.

Your company has been renamed Arctic, which is probably a more potent name from a marketing point of view, in that it symbolizes Canada. Do you expect to get more involved in marketing your product?

We recognize that we are diamond producers, and that’s what we’ve got to focus on. We are an active member of the Natural Diamond Council, and so we actively participate in that and contribute to that initiative through our membership fees. We think that the Natural Diamond Council is doing a great job of promoting natural diamonds. We recognize that if you wanted to do a good job of marketing a luxury product like diamonds, you’ve got to have a big budget for that, and that’s just not where we fit in. All of us producers together are much more powerful than individuals trying to do that separately.

A lot of producers are looking into origin certification? Will you do that?

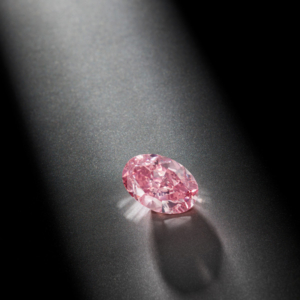

A percentage of our diamonds are sold through the Canadamark program. They tend to be the higher-quality goods. We think it’s an important consideration, given that the new generations of customers are much more concerned about the origin of the products that they buy and that the products have been produced a sustainable way. I think Canadian-origin diamonds are highly prized by millennials because they know that Canada has high environmental guidelines and social economic guidelines and the way we run our mines in Canada is of the highest standard. That’s not to say that a diamond produced in Africa has not been ethically produced, because the big mines in Africa are run according to the highest international standards. There may be a perception that all these African [stones] are still blood diamonds, but the reality is that the absolute majority of diamonds coming out of Africa are produced in a very ethical way. But Canada does have brand appeal.

There’s been talk of new factories in Canada. That’s been tried before, and it didn’t work. Do you think Canadian cutting has a future?

I think it’s always going to be a challenge to manufacture diamonds in Canada, particularly in the north. You are competing against India, and India has really done an incredible job of capturing that part of the supply chain of diamonds. You can’t compete on costs, and they actually have become incredibly skilled at polishing diamonds.

It’s admirable to see people try, because the more we can capture business opportunities in Canada, the better. But I think it’s a struggle.

Do you expect rough diamond prices to continue to remain strong?

At the moment, everybody in the business expects that rough diamond prices will remain strong in the short- to medium-term. Obviously, it’s very difficult to predict longer term. Supply has been impacted by COVID, so supply of rough diamonds is lower than it was forecast to be. Demand is incredibly strong, fueled mostly by the U.S. and China. There’s been very strong demand for our product, and the commentary over the holiday season was that sales were very strong on the retail side. In the short-term, I think the macro factors for our industry, and for rough diamond prices, are very good.

(Photos courtesy of Arctic Canadian Diamond Co.)

Follow JCK on Instagram: @jckmagazineFollow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine