Signet’s same-store sales rose 7% in its latest quarter, but executives expressed caution about the year ahead, fearing the COVID-19 pandemic’s end could shift consumer spending back to travel.

“As the vaccine rollout progresses, there could be a shift of consumer discretionary spending away from the jewelry category toward experience-oriented categories,” said chief financial officer Joan Hilson on a conference call following the release of Signet’s financial results.

Hilson said that Signet will boost its marketing spend to counter this anticipated shift, though it expects same-store sales will fall over the next year.

The company also plans to close as many as 100 stores over the next year, but it will also open up to 100 stores, primarily Piercing Pagoda kiosks.

Signet is also testing new concepts, including Kay–Zalex and Jared–James Allen combination stores, as well as pop-up stores.

On the call, CEO Gina Drosos said the company has ambitions to enter new areas, including rental services and subscription offerings, and wants to feature more new designers.

“In Zales, we have already begun a process of discovering new designers,” she said. “We can help them with our vendor relationship to develop their product lines.”

She noted that Jared’s custom-design Foundry concept, recently launched in 19 stores, will soon be expanded to 50.

Signet has also launched a wholesale diamond marketplace for independent jewelers.

“[It leverages] our scale in diamond buying,” Drosos said. “That is very early, but proving to be a good new business for us.”

Signet’s sales growth for the fourth quarter of 2021 (ending Jan. 30) was largely driven by a jump in e-commerce sales, which soared 70.5%, and now represent 23% of its overall sales. Comps at its brick-and-mortar stores dropped 4.2%. Overall sales totaled $2.2 billion. Operating income was $294 million, up 9% from the prior year.

Drosos noted the company has eliminated $300 million in operating costs in the past three years, surpassing its original target of $200 million, and has decreased its store footprint by 20%.

Hilson said that Signet permanently closed 395 stores over the last fiscal year, and it moved 33 mall stores to off-mall locations. It also opened 20 new Piercing Pagoda stores over the last year.

The company has invested heavily in technology, particularly data analytics.

“We now have a much more granular understanding of customer behavior,” Drosos said.

Signet has moved its banner websites onto a unified platform, enabling a “much more seamless customer experience,” Drosos said.

And it has changed its marketing mix, with Kay Jewelers cutting its television spend in half while doubling its digital marketing.

“We have shifted significantly toward digital, which enables customized communication, but we are still able to command a leading TV presence in the jewelry industry at the same time, which builds awareness and brand equity,” she said.

Regarding Signet’s recent commitment to pay all employees a $15 minimum wage by next year, Drosos said, “It’s an opportunity to not only continue to attract great talent but continue to elevate the employee experience.”

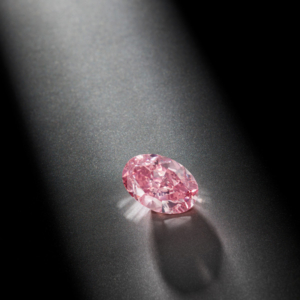

(Photo courtesy of Signet Jewelers)

Follow JCK on Instagram: @jckmagazineFollow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine