Pandora enjoyed a record year in 2021, with U.S. sales soaring, but CEO Alexander Lacik (pictured) foresees an eventual “correction” to its growth in America.

“We are expecting that U.S. growth will slow down a little bit further on a year-over-year comparison,” said Pandora executive vice president and chief financial officer Anders Boyer on a conference call following its financial results.

The company still expects to outperform the rest of the U.S. jewelry market, which it predicted will shrink by 10%–20% in 2022. Pandora expects its U.S. sales will fall in the “single digits” over the next year.

For the moment, though, the U.S. market remains “on fire,” as Boyer put it. In the fourth quarter of 2021, sell-out growth rose 39% versus the fourth quarter of 2019—which is actually below Pandora’s U.S. growth level during the first nine months.

The company noted that it still hopes to eventually double its 2019 U.S. revenue. In response to a question, Lacik didn’t think that inflation would be a big factor hampering growth.

“Historically, when there’s big inflation, [the mid-price segment] seems to have suffered less than others,” he said. “Is that going to repeat itself? Time will tell. I don’t think it’s going to be a huge drama.… At least, that’s not what Pandora has experienced in the past.”

Lacik noted that the brand performed well in all its major markets except for China, where its performance was “unsatisfactory.”

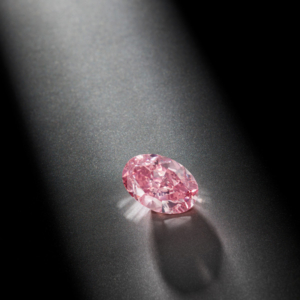

Its new lab-grown diamond line, Pandora Brilliance, performed well, and the brand plans to put additional “muscle” behind it as it expands worldwide, executives said.

But Lacik declined to say where the line is headed next. “We won’t roll into many markets in one go,” he said.

He noted that the Brilliance line has probably attracted more “gifters” than it originally predicted, as Brilliance was originally conceived a self-purchase product.

In January, Pandora announced that it was repurchasing 37 franchise stores in the U.S. and Canada from Ben Bridge Jeweler, its largest North American franchisee.

The company’s full-year organic growth was up 23% versus 2020. It also announced a share buyback program of 3.3 billion Danish kroner.

(Photo courtesy of Pandora)

Follow JCK on Instagram: @jckmagazineFollow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine