Signet Jewelers has agreed to purchase Diamonds Direct for $490 million in cash.

The transaction will close in the fourth quarter of this year and is subject to customary approvals. Diamonds Direct president Itay Berger will remain at the company’s helm, reporting to Signet CEO Virginia “Gina” Drosos.

The Charlotte, N.C.–based jewelry chain will be “immediately accretive to Signet post-closing,” Signet said in a statement.

Signet spokesperson David Bouffard says that Diamonds Direct will “operate as a separate and distinct banner within Signet, with its headquarters remaining in Charlotte for the foreseeable future.”

He calls Diamonds Direct a “growth opportunity” for Signet.

“It is complementary to our existing banners,” he says. “The cash deal [brings] higher-end bridal customers who typically spend more on engagement rings and other wedding accoutrements than shoppers at the company’s other brands.”

He adds that “research indicates that Diamonds Direct’s customers have minimal overlap with our current Signet customer,” as Diamonds Direct’s “younger and luxury-oriented” shopper “prefers in-store counsel and education, with ready access to physical merchandise.”

According to a presentation that was part of a 2017 court case, 56% of Diamonds Direct’s shoppers have an income over $100,000.

Founded in 1995, Diamonds Direct currently comprises 22 stores, as well as one watch boutique in Charlotte, N.C., according to its site. The company’s prime base is in the Southeast, but it also has stores in Ohio and Indiana.

Its general marketing strategy has been to attract male engagement ring buyers with professional sports and collegiate team sponsorships as well as heavy radio and print advertising. (The 2017 presentation noted it was the heaviest local radio ad buyer in several of its markets.)

Diamonds Direct does not carry lab-grown diamonds “at the present time,” says vice president of marketing and branding Kelsey Halford Diachenko. It has primarily concentrated on brick-and-mortar, though it has a “budding” e-commerce and omnichannel strategy, Diachenko says.

Diamonds Direct has been owned since 2015 by Blackstone Tactical Opportunities, a division of the Blackstone Group. At that time, it had only five locations and was about to open two more—so Blackstone has more than tripled the chain’s size in its six years of ownership.

This is Drosos’ third acquisition since taking over Signet four years ago, after James Allen in 2017 and Rocksbox this past April.

Signet also significantly upped its current guidance for fiscal 2022 (its current fiscal year)—a sign of confidence for the holiday. It now expects comp sales to rise from 10 to 12% in the third quarter, up from its original forecast of -3 to 1%. It expects to post non-GAAP operating income of $53 million to $63 million, whereas it previously predicted $10 million to $25 million.

“Customers are showing positive response to our new product launches, and the reduction in government stimulus and customer shift to spending on entertainment and travel are having less impact than we previously anticipated,” said Joan Hilson, chief financial and strategy officer, in a statement. “While there remain factors beyond our control, our strengthened supply chain and vendor partnerships gave us the ability to plan earlier receipt of holiday product, and we currently do not expect any material supply chain disruptions. Signet uses air freight for the transit of the vast majority of our merchandise, thus avoiding current ocean freight congestion.”

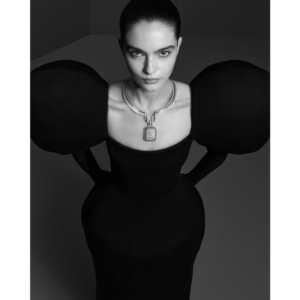

(Photo courtesy of Diamonds Direct)

- Subscribe to the JCK News Daily

- Subscribe to the JCK Special Report

- Follow JCK on Instagram: @jckmagazine

- Follow JCK on X: @jckmagazine

- Follow JCK on Facebook: @jckmagazine