At an industry event last week, an old friend reproached me for my recent headline that called allowing imports of Russian-mined diamonds that were cut elsewhere a “loophole.”

That’s not a loophole, this person argued. That’s what the U.S. government wanted. It specifically exempted goods that were “substantially transformed” (i.e., cut and polished) from its definition of Russian-origin diamonds. Granted, that’s such an odd—and counterintuitive—distinction that the U.S. Customs and Border Protection’s 2019 order banning Marange diamonds didn’t even mention it. But that’s what the government put out there.

My friend had a point. It’s been over a month since Russia launched its brutal invasion of Ukraine, and to my knowledge, not one country has issued a blanket ban on Russian-mined diamonds. (The United States is one of the few countries to order any kind of Russian diamond ban, and its prohibition only bars a very small amount of stones.) The human rights groups in the Kimberley Process Civil Society Coalition aren’t even calling for the certification scheme to disallow them. It’s like everyone is playing this weird game of “you first.”

Yet, while legally not much may have changed, culturally, the ground has shifted.

Recently, we have seen Signet, Brilliant Earth, and, on Friday, Tiffany—three companies known for having a good handle on their natural-diamond sourcing—say they will no longer buy Russian gems. The wording of these declarations is sometimes fuzzy—for instance, one company said it would “ask” its suppliers to stop sending Russian goods, rather than using the stronger term require. No doubt lawyers were paid big money to finesse that language.

Regardless, these jewelers—and many others—are going above and beyond current law. Which they should. They are public companies that must manage risk. Two weeks ago, Jewelers of America pointed to three types of potential jeopardy when buying Russian goods: “ethical, reputational, and legal.”

I consider that a helpful framing; let’s take those one by one.

First, let’s look at ethical considerations. I don’t like to preach, as I don’t have the same skin in the game as my readers do. I don’t have factories to run, or employees to feed. We all have to search our consciences on this.

The industry has tried for years to convince consumers that “Diamonds Do Good.” If it really believes that message, if it really wants to show the world that it’s better than its reputation, if it truly wants to prove this is an industry that cares about people and not profits, it can at least stop diamonds from doing bad.

There is nothing wrong with Alrosa’s diamonds. The issue is: Who benefits from them? For now, these gems are helping its 33% owner, the Russian government, conduct its brutal war on Ukraine. And every time you purchase a newly mined Alrosa gem, you could be helping to finance that slaughter. In fact, Alrosa’s links to the Russian military appear to be stronger than originally thought. And if Russia begins cyberattacks on the United States, as predicted, you’d be unwittingly assisting mayhem here too.

There’s a counterpoint to this ethical argument: Not buying Russian-mined diamonds could hurt innocent mine workers, and Indian cutters. That is true. Hurting poor laborers is not a small thing, it is not an abstract thing; it shouldn’t be waved away. Sanctions might also hurt the U.S. economy. None of these possible impacts should be minimized, or barred from discussion.

Unfortunately, there don’t appear to be many other tools to end this war, nor any other way for people legitimately repulsed by the Russian invasion to separate themselves from it. The consequences of a Russian ban might not be fair, but what’s happening to innocent people in Ukraine is far worse.

Others argue that Russia’s diamonds will simply be sold elsewhere, or cutters will just lie, making any ban pointless. Which is certainly possible, but saying the ban won’t change anything somewhat contradicts the argument that it will hurt innocents. Plus, factories do have alternatives. During last year’s (nonpolitical) supply squeeze, some Indian cutters began producing lab-grown diamonds to keep their factories humming.

Whatever effects these sanctions have, one man bears responsibility for them: Russian President Vladimir Putin. He knows continuing his invasion has the potential to hurt innocents in Russia and India. He clearly doesn’t care if the diamond industry is ruined, just as he doesn’t care about the damage done to Russia and Ukraine. Hopefully, common sense will prevail, and he’ll end his invasion and save what’s left of his country. Lately, his track record hasn’t been great. But if you don’t like this mess, blame him. He started it. He can end it.

As far as reputational risks, continuing to sell Russian diamonds could present serious public relations problems for the industry, whose image already isn’t so great.

For the moment, the diamond industry may—ironically—be benefiting from the widespread consumer perception that all diamonds are produced in Africa from dollar-a-day artisanal miners. Again, ironically, the industry once thought educating consumers that diamonds came from Russia was a good thing.

Most still don’t know that Russia is a major diamond producer, but that could change quickly. Alrosa’s prominence is no secret, nor is the fact that it’s one-third owned by the Russian government. The Russian invasion of Ukraine is a high-profile issue, the industry’s supposed “silence” has already been criticized in the press, and at least one lab-grown company is using the topic to get attention.

For the time being, jewelers say few consumers are asking about Russian diamonds. Which is why this is the perfect time to act, before it becomes an issue, just like it’s best to stop committing a crime before the cops catch you.

President Biden recently warned about potential cyberattacks on the United States. Many already view Putin as akin to Hitler. If Russian cyberattacks cause casualties in the United States, then he also becomes Osama bin Laden. The industry is still dealing with fallout from conflict diamonds—a problem that peaked 20 years ago and which few consumers truly understand. You think blood diamonds are bad? Try selling a Hitler/bin Laden diamond. That, shoppers will easily understand, and avoid.

Finally, let’s look at legal risks.

Sanctions tend to start small, then ratchet up. So first, the U.S. government put minor sanctions on Alrosa. Then, it sanctioned diamonds purchased directly from Russia but—as mentioned—allowed Russian-mined diamonds cut elsewhere. The point, I’m told, is to give the industry a chance to get its act together before the next wave of sanctions.

The trade needs to use this time wisely, because it’s quite likely more sanctions are coming. Unless the Russian government reverses its current trajectory, the U.S. government probably won’t either.

All the U.S. government has to do is remove two words from its definition of Russian-origin diamonds—substantial transformation—and the entire diamond world will be turned upside down. The industry needs to prepare for that possibility. Any ban might include a grace period that allows current contracts to be redrawn and rewritten. And it might not.

I hope, if the United States does take action regarding Russian diamonds, it does so carefully and thoughtfully. I’ll admit, the U.S. government has a mixed track record when it comes to industry regulation; see Section 1502 of the Dodd-Frank Act, which some still refuse to admit significantly hurt the Democratic Republic of Congo.

A badly conceived Russian import ban may cause similar chaos, but I believe smart companies are already preparing for any eventuality. And if not, they should be.

But let’s not just focus on the negative. A ban might spur much-needed action. A possible analogy is the COVID-19 lockdowns. They were painful and scary at first. But they ended up giving some jewelers the push they needed to sell more online. The benefits since have been obvious.

Perhaps this crisis will spur the industry to get serious about source-tracking, which has been an ongoing issue since public attention was first brought to conflict diamonds nearly 25 years ago. The trade should be way farther along on tracking than it is, as situations like this keep popping up. There’s already a variety of commercial solutions now on the market. Knowing where your material originates needs to be a regular part of industry practice.

That could mean more paperwork. It may even change the way the trade does business. But if I told a diamond dealer in the 1930s, “One day, you’ll have to send every diamond to a lab to be graded,” he’d probably whine and complain. Today, nobody thinks twice about it.

Wouldn’t it be better if the industry self-regulated? Sure, but apart from a few big brands, it hasn’t so far. Russian diamonds are flowing freely. The big international associations are split on how to handle Russia. There are also apparent legal concerns when brands or groups take, or recommend, actions that go beyond existing law. I can’t imagine anyone suing over this, but lawyers are, by nature, cautious. Plus, if just one company doesn’t comply, that creates an unequal playing field that rewards bad actors.

Government edicts are clarifying. People can endlessly debate on LinkedIn the morality of banning Russian-mined diamonds, but in the end, companies must do what the law tells them to, or face the consequences.

It’s probably impossible to completely ban Russian diamonds from U.S. shores. While many (but not all) manufacturers are able to segregate diamonds by origin, I don’t think it will ever be possible to origin-test every piece in a large parcel of melee, nor do I think that would be a particularly constructive use of anyone’s time.

A while back, I talked to people at SCS Global Services, and they mentioned the company’s protocol for testing shrimp. (That industry, apparently, has nasty elements to it.) It doesn’t test every single piece of shrimp in a bushel, but rather looks at random samples from random bushels. Its lab-grown and natural diamond tracking systems work the same way.

That’s not a perfect guarantee. But it’s an acceptable one, and it shows that even seemingly unsolvable problems can have at least adequate solutions. (After all, shrimp are small. They’re shrimp.) While melee can be a big business, it’s probably not worth stressing over the origin of a one-point stone that costs very little. These are issues we need to start discussing.

I hope the industry and the government will join together to find a workable import ban, which would encompass most diamonds, gemstones, or precious metals mined, cut, or lab-created in Russia, or sold by a Russian entity.

The government needs to be open to answers that take into account issues like size, date, and the difficulties in tracking artisanal production. And the industry needs to understand this issue isn’t going away.

Any guidelines need to be not just practical but understandable, and jargon-free. Some jewelers’ brains turn off when they read the letters OECD.

At the moment, in the absence of U.S. regulations, the trade has a decision to make. Big jewelers may have the resources to avoid buying Russian diamonds, but small stores could have a tougher time. They may need to talk to sourcing experts and review existing tools and tracking systems. For independents, the U.S. Jewelry Council’s Source Warranty Protocol might be the best bet. I hope to expand lists of resources in weeks to come, and readers are welcome to provide input and possible solutions, either here or by email.

Some of these systems depend on vendors’ assurances. Of course, vendors may not always tell you the truth—though if you don’t trust your vendors, you probably shouldn’t buy from them.

In the end, we can’t ignore this problem. The stakes are too high. This issue is too big, and it will only get bigger.

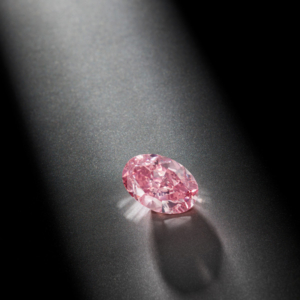

(Photo: Getty)

Follow JCK on Instagram: @jckmagazine

Follow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine