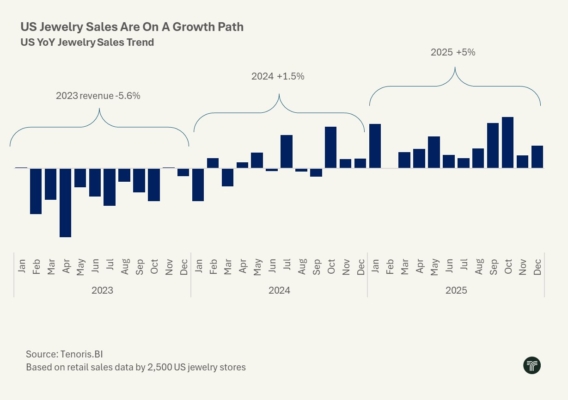

Independent jewelry stores in the U.S. generally saw good business during 2025—though their sales increases slowed a bit during the holidays, according to figures compiled by Tenoris, an industry analytics service.

Year-over-year, jewelers’ sales jumped 5.6% in 2025 but rose only 3% in November and 5.4% in December, Tenoris said.

“It’s kind of odd,” company cofounder Edahn Golan tells JCK. “December was okay, it was better than last year, but there was a lot of hope that the holiday would be exceptional, and it wasn’t.”

The year’s sales increase was driven by an 11.4% rise in average price spent per item, which offset a 5.2% decline in the number of pieces purchased. That drop in the number of purchases was concentrated in items under $2,500, Golan says.

This disparity was particularly pronounced in December, when consumers bought 10% fewer items than the prior year, while paying 17.2% more for them.

Loose diamond sales declined during 2025, with loose natural diamonds the worst-performing segment in the industry, as they continued to cede market share to lab-grown.

Unmounted lab-grown sales revenue fell 1% during 2025, even as unit sales rose 14%. However, average price fell 13%—but that was an improvement from the 24% price decline tallied in 2024.

“All of the metrics in lab-grown are moderating: the decline in price, the rise in unit sales,” Golan says.

He notes that 2025 was the first year that jewelers’ gross profit on natural diamonds topped that of lab-growns, even if the gross margin percentage on lab-growns remained much higher. In fact, despite falling wholesale prices, independent jewelers increased their margins on lab-growns this year, to a whopping 72%.

“Jewelers aren’t passing the decline in lab-grown prices on to consumers,” Golan says. “They’re trying to protect themselves.”

Gold had the opposite problem as lab-grown, as its price rose 66% during 2025. In most cases, retailers didn’t pass the full increase along to consumers, though they hiked the price of gold items some 30% during the year, and offered lighter items than usual.

That wasn’t enough to entice shoppers, and unit sales of gold jewelry fell 16% for the year.

All in all, the numbers paint a mixed picture: Overall jewelry sales were strong, but lower-income consumers seem to be spending their money elsewhere.

“Despite some of the economic numbers you hear, there’s a certain sector of consumers that aren’t benefiting,” he says. “We’re seeing a lack of confidence in parts of the market.”

(Photo: Getty Images)

- Subscribe to the JCK News Daily

- Subscribe to the JCK Special Report

- Follow JCK on Instagram: @jckmagazine

- Follow JCK on X: @jckmagazine

- Follow JCK on Facebook: @jckmagazine