Charles & Colvard is getting back to its roots.

For the past few years, Charles & Colvard executives seemed to devote most of their earnings calls to discussing lab-grown diamonds, which were added to the company’s product mix in 2020. But now the brand is again focusing on the (also lab-grown) gemstone that made its name: moissanite.

“Moissanite is our core business,” Don O’Connell, president and CEO of the Research Triangle Park, N.C.–based company, tells JCK. “We need to own that, first and foremost.”

Going forward, not only will Charles & Colvard put a greater emphasis on its signature gem—and its two brands, the new Forever Bright and the higher-end Forever One—but it will sell moissanite direct to independent jewelers.

“It’s a huge move for us as a company, because for the past 27 years we mostly sold to a handful of large distributors that controlled the flow, the messaging, the story line, to all the independent jewelers,” O’Connell says.

“The distributors in our arsenal shifted in large part to lab-grown diamonds, and that was a problem. So now we’re going direct to retailers, giving them an [online] access portal, thus cutting out a layer between wholesaler to distributor to independent.”

While Charles & Colvard will continue to sell lab-grown diamonds—which still represent a good percentage of its business—their dramatic price declines have made that sector considerably less profitable, and less of a priority, O’Connell says.

He notes that some online retailers that are big players in lab-grown diamonds, like Brilliant Earth, have begun to offer moissanite.

“There’s a tremendous amount of people adopting it,” says O’Connell. “They’re looking for items they can make margin on. At first they thought that it would be lab-grown diamonds. But when they wanted to do Google paid search marketing, they realized they were getting blown out of the water, because the cost per click is just ridiculous. You can’t compete with people spending millions of dollars in advertising per quarter.

“So many people and stores [based] their business on lab-grown diamonds. There’s no question that they’re getting hurt, they have been hurt, or they will get hurt. And they will have to look for other products.”

O’Connell admits that Charles & Colvard has sustained a bruise or two, as the continual drop in lab-grown prices also dented the price of moissanite. Whereas a carat of moissanite once sold for anywhere from a tenth to a fifth of the price of a comparable lab-grown diamond, it now sells for around 50 percent less.

“We want to increase that delta, and sell to retailers at the cost that we used to sell to distributors for,” he says. “We are going to be lowering our pricing of moissanite because we don’t have to layer in these big wholesale margins for distributors. That will also allow us to redeploy capital, marketing materials, and different types of incentives at the independent jeweler level.”

The company hopes to take some market share from Chinese manufacturers, who began producing moissanite after Charles & Colvard’s patent expired in 2015. They are offering an inferior product, though, according to O’Connell.

“People are utilizing different types of silicon carbide and saying it’s comparable to what we’ve built and innovated for years. They say that they have colorless moissanite, and flawless moissanite, and it’s not. And that’s a problem. Look to us to talk about why not all moissanite is created equal, and this is why.”

Even though Charles & Colvard’s current slogan is “Made, Not Mined,” O’Connell doesn’t rule out selling natural diamonds in the future.

“In relatively short order, we could offer all the choices to the consumer, as long as they’re made responsibly. We have never taken a stand against natural diamonds. I spent decades in that world.” (O’Connell formerly worked for Richline.)

One of the few publicly traded jewelry companies, Charles & Colvard has faced the threat of being delisted from NASDAQ, as its shares are currently trading below the exchange’s $1 threshold. The company recently put out a proxy statement calling for a vote on a reverse stock split to regain compliance.

Otherwise, O’Connell says, the company is debt-free and has “plenty of cash.” It has spent a lot of money, he says, on marketing, building the new Charles & Colvard Direct trade portal, and doing a refresh of its consumer website, which it will debut soon.

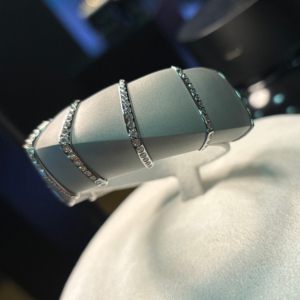

Top: A Charles & Colvard 2.39 ct. t.w. Forever One moissanite marquise engagement ring (photos courtesy of Charles & Colvard)

Follow JCK on Instagram: @jckmagazineFollow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine