The board of Anglo American, the majority owner of De Beers, has unanimously agreed to turn down a $39 billion all-stock buyout offer from mining giant BHP.

“The BHP proposal is opportunistic and fails to value Anglo American’s prospects,” Anglo American chairman Stuart Chambers said in a statement.

Anglo’s board seemed to particularly object to a provision that the company sell off its Anglo American Platinum and Kumba Iron Ore units prior to an acquisition.

The bid’s structure was “highly unattractive for Anglo American’s shareholders, given the uncertainty and complexity inherent in the proposal and significant execution risks,” said the statement.

Anglo also had to contend with reported objections from the government of South Africa, which disliked the idea of Anglo being forced to sell certain South African assets.

“There are fewer and fewer companies that believe in the country and have invested in it like Anglo,” Zwelakhe Mnguni, chief investment officer of Johannesburg-based Benguela Global Fund Managers, said in the Financial Times. “It has a rapport with the government, and understood the lay of the land, and if this vanishes, I don’t see BHP filling that gap.”

Some analysts consider this merely BHP’s first attempt, with one telling The Guardian to expect other offers for Anglo, either from BHP or someone else.

“The fact that [Anglo’s] shares are trading just above what BHP is offering suggests one of two things—either BHP is going to up its offer or sweeten the deal in some way, or a second offer comes forward from another diversified miner, like Glencore,” Jamie Maddock, energy analyst at Quilter Cheviot investment firm, said.

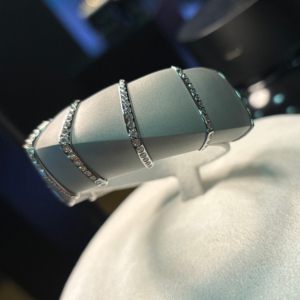

Deal or no deal, Anglo’s 85% shareholding in De Beers remains very much in doubt. Yesterday, The Wall Street Journal reported that Anglo was talking to possible buyers, including “luxury houses and Gulf sovereign-wealth funds.”

BHP has said in a statement that it if it purchased Anglo, it would subject its assets—with “its diamond business” singled out—to a “strategic review.”

(Photo courtesy of Anglo American)

Follow JCK on Instagram: @jckmagazine

Follow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine