Anglo American has held discussions related to a possible sale of De Beers, according to reports in The Wall Street Journal and the Financial Times.

The Journal reported that Anglo been talking with “luxury houses and Gulf sovereign-wealth funds” about possibly selling its 85% stake in the diamond miner. (The other 15% is held by the government of Botswana.)

“Anglo has signaled to potential suitors that it is open to offers,” said the Journal, quoting unnamed sources. “An eventual buyer might be a combination of a luxury house and a financial investor.”

FT similarly reported that “Anglo American has sounded out potential buyers of De Beers including Gulf sovereign-wealth funds, luxury houses, and wealthy individuals in recent weeks, according to two people familiar with the matter.”

Both De Beers and Anglo declined comment.

De Beers’ poor 2023 results have sparked significant speculation about its fate, especially after Anglo wrote down the company’s book value by $1.6 billion in February.

Anglo American has owned 85% of De Beers’ since 2012, after the Oppenheimer family sold Anglo its 40% stake. Before that, the two companies were generally considered corporate siblings, as Anglo was founded by Sir Ernest Oppenheimer, the former chair of De Beers. For decades, Anglo and De Beers were linked through an intricate series of cross-holdings, which were unwound when De Beers went private in 2001.

Reports of a possible De Beers sale come amid news that Anglo may itself be sold. On Wednesday, Anglo confirmed that BHP, the world’s largest mining company, has made an “unsolicited, nonbinding” $39 billion all-stock bid for Anglo, which is conditional on the company selling its Anglo American Platinum Ltd. and Kumba Iron Ore units.

Anglo gave BHP until May 22 to make a final offer. Its statement added: “There can be no certainty that any offer will be made nor as to the terms on which any such offer might be made.”

The Wall Street Journal story about De Beers said, “Anglo’s discussions about selling the diamond unit are believed to have been separate from [BHP’s] takeover bid.”

In a statement, Melbourne, Australia–based BHP said that if its offer is accepted, “Anglo American’s other high-quality operations, including its diamond business, would be subject to a strategic review post-completion.”

A memo to De Beers Group employees obtained by JCK said that “whilst [news of BHP’s bid] may be unsettling for many in Anglo American and De Beers, it is vital that we all remain focused on our jobs. Above all, we must continue to put safety first. We have a strong Origins strategy and an important plan for 2024 which we need to deliver.”

De Beers asked employees in the memo to “not be drawn into discussing this proposal with external stakeholders, or commenting upon it on social media or other channels.”

BHP has previously dabbled in diamonds; for 14 years it was the majority owner of Ekati, the first diamond mine in Canada’s Northwest Territories. It sold its stake in Ekati in 2012, as part of a larger exit from the diamond industry.

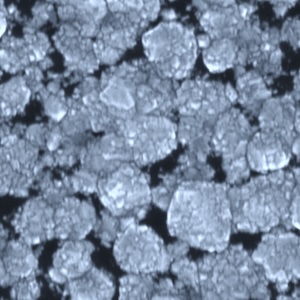

Top: Botswana’s Jwaneng diamond mine, which is partly owned by De Beers (photo courtesy of De Beers Group)

Follow JCK on Instagram: @jckmagazineFollow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine