Signet Jewelers announced it would close as many as 150 locations after its comps fell 13.9% in the first quarter of its 2024 fiscal year (ended April 29).

On a conference call following the release of its financial results, Signet’s chief financial, strategy, and services officer Joan Hilson said it was targeting “underperforming” stores, mostly in mall locations.

Overall, Signet’s sales fell 9.3% from the same quarter last year, to $1.7 billion. Operating income was $101.7 million, up from $200,000 last year.

Signet CEO Gina Drosos blamed the drop on “macroeconomic headwinds that worsened late in the quarter” and an anticipated decline in people getting engaged, due to less dating during the COVID-19 pandemic. But she said that trend should reverse itself by next year.

“We have identified and tracked a proprietary list of 45 milestones that trace a couple’s journey through four major relationship stages—meeting, exclusivity, committed, and engagement,” she said, according to a SeekingAlpha transcript. “Couples traveling together is one of the top milestones later in the couple’s journey to engagement.… Searches for ‘couple’s vacations’ on TikTok are currently twice what they were in [the previous quarter].”

The sales decline was also fueled by a drop in average transaction value, particularly in bridal, which represents 50% of Signet’s business.

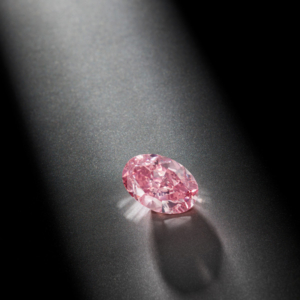

In response to a question, Drosos said lower average transaction was not due to price reductions for lab-grown diamonds.

“We’ve consistently seen [lab-created diamond customers] trade up to a larger stone,” Drosos said, noting that lab-created diamonds currently constitute about 15% of its business.

“We believe that the majority of our customers still prefer their rarity that comes from buying a one-of-a-kind natural diamond,” she added.

Drosos said the company has increased its fashion business by 36% in the past three years, making it a bigger portion of its mix.

“In fashion, we continue to see pressure at lower price points, as has been the case for the past year,” she said. “However, later in the quarter, we began to see degradation at higher price points, between $1,000 and $5,000 in fashion. Price points remain strong at $5,000 and above.”

One bright spot was Signet’s services business—particularly repairs and warranties—which grew more than 5% over last year. The custom jewelry segment also “bucked the [larger] trend,” showing growth over the quarter, Drosos said.

Hilson said last year’s acquisition of e-tailer Blue Nile is “doing quite nicely for us,” and “the combination of the digital banners [James Allen and Blue Nile] has really demonstrated strength.”

Drosos also said that Signet would continue to invest in its business, particularly in increasing its data capability. “We’ve already built nearly 30 million customer profiles,” she said. “I want to put this into perspective for you. We estimate those 30 million customer profiles represent roughly 40% of U.S. jewelry customers who make a purchase in a given year, and we’ve been adding over 1 million new profiles every month.”

The company lowered its guidance for fiscal year 2024 to $7.1 billion–$7.3 billion in sales, with operating income of $635 million–$675 million. That’s down from its prior sales guidance of $7.67 billion to $7.84 billion, and operating income guidance of $765 million to $800 million.

Signet also repurchased $39.1 million of shares during the first quarter, and issued a $0.23 per share cash dividend for the second quarter.

Top: Kay Jewelers, one of Signet’s brands (photo courtesy of Signet Jewelers)

Follow JCK on Instagram: @jckmagazineFollow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine