Junaid “Jay” Sahibzada, the owner of two jewelry stores in Independence, Mo., pleaded guilty in federal court on Aug. 4 to one count of evading federal reporting requirements by failing to file a Form 8300, according to a statement from the U.S. Attorney’s office.

Sahibzada, 37, co-owns the kiosk Gold-N-Time and the store Jawa Jewelers. Both are located in the Independence Center mall.

The U.S. Attorney’s office alleged that Sahibzada met with an undercover federal agent posing as a heroin dealer interested in laundering money by purchasing jewelry from Gold-N-Time with cash. The undercover agent told Sahibzada he did not want the government to know about the purchases; Sahibzada allegedly told him that would not be a problem because no one would know about cash purchases.

After the undercover agent purchased two pieces of custom jewelry from Sahibzada for $21,100, the jeweler did not file or instruct any employee to file a Form 8300, prosecutors said. Federal agents reported that Sahibzada later admitted that he had never filed an 8300, despite engaging in numerous cash transactions over $10,000.

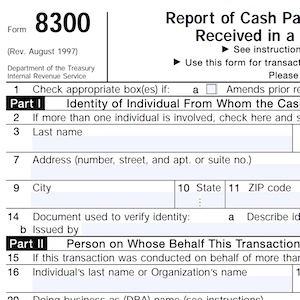

Business are required to file a Form 8300 with the Internal Revenue Service if they receive more than $10,000 in cash in a single or related transactions. The filing must be done within 15 days of the transaction, either manually or electronically. IRS guidelines can be seen here.

Under the terms of his plea agreement, Sahibzada must pay a monetary judgment of $21,100. He also faces possible prison time. His lawyers did not respond to a request for comment.

Filing 8300 is “is an important part of all business operations, regardless of whether you are required to have an anti–money laundering program in place, and all businesses must follow this requirement,” notes Sara Yood, deputy general counsel of the Jewelers Vigilance Committee.

(Image from the IRS)

Follow JCK on Instagram: @jckmagazineFollow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine