Signet Jewelers says the positive consumer mood has boosted both its conversion rates and average ticket price, and as a result the company has raised revenue and income guidance for the first quarter and the fiscal year.

It now expects its revenue for the 2022 fiscal year—which started in February—to fall somewhere between $6 billion and $6.14 billion, up from previous guidance of $5.85 billion to $6 billion. First-quarter revenue will hit $1.57 billion to $1.60 billion, up from the previously forecast $1.42 billion to $1.46 billion.

The company’s statement did contain a few provisos, warning that, as the vaccine rollout continues, consumer spending could shift from jewelry to more experience-oriented categories like travel. It also expects those categories with pent-up demand to become more promotional.

As a result, Signet expects comps in the second half of the fiscal year to be negative—though it’s planning to fight any increased competition by boosting its marketing efforts.

It also said that while it’s planning to close 100 stores over the next year, it will also open 100, “primarily in highly efficient kiosks.” Over the last few years, its kiosk-based Piercing Pagoda division has turned into one of its best-performing banners.

Signet is also planning to spend between $150 million and $175 million in capital expenditures over the next year, mostly on “innovation” and improving digital capabilities.

That will be partly made up by projected, but unspecified, cost savings of $50 million to $75 million.

One way the retailer has been conserving cash is by extending vendor terms, chief financial officer Joan Hilson told the Wall Street Journal.

Some of the payment extensions Signet put in place during the early days of the pandemic have not been lifted, Hilson said, with the company nearly doubling its days payable outstanding.

The announcement sent Signet stock soaring to $64 at publication time, just below its 52-week high of $68. That is more than nine times its 52-week low of $7.

Signet recently purchased jewelry subscription and rental service Rocksbox for an undisclosed sum.

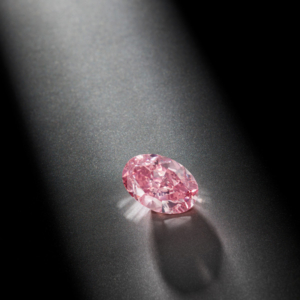

(Photo courtesy of Signet Jewelers)

Follow JCK on Instagram: @jckmagazineFollow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine