The seeming end of the COVID-19 pandemic as well as the global uncertainty sparked by Russia’s invasion of Ukraine make predicting future diamond demand difficult, De Beers CEO Bruce Cleaver (pictured) told JCK last week, following the release of its 2021 financial results.

“It’s obviously a question we think about a lot,” he says. “We have seen tremendous demand, in particular in America in the last 18 months, and that has been driven by a lot of factors, some external and some internal. The stimulus, people not traveling—all those things are probably not repeatable.”

Still, he feels positive about the year ahead.

“I don’t think we’ll see the same levels of demand we’ve seen in the last 18 months,” he says. “But there are some good signs. The levels of inventory in the midstream, and rough and polished in the downstream, are much more in balance than any time that I could remember. The financing in the mainstream is in good shape. It’s absolutely clear that consumers love this product as much as they ever did.

“As demand reaches more normal levels, [we must consider] how we’re going to keep capturing that demand,” he adds. “We’ve got to catch different consumers in different ways, and we shouldn’t lose the opportunity that this pandemic has given us. It’s forced us to do things differently.”

Cleaver notes that De Beers spent about $200 million on marketing last year—a number that harks back to what it spent in the “single channel” days—which includes its contribution to the Natural Diamond Council.

“We certainly would intend to continue spending at about that level,” he says. “There’s no intention to start reducing those numbers. I think you will continue to see us invest significantly in the market.”

He adds that “markets like India have surprised us as to how well they’ve done. China has been more mixed.”

When asked about Pandora’s prediction that the U.S jewelry market will shrink 10%–20% this year, Cleaver said that sounded high.

“Polished demand remains good,” he says. “I don’t think we have seen anything that would suggest that level of decline.”

JCK spoke to Cleaver on Feb. 22, just before the U.S. imposed new sanctions on Alrosa, and prior to many countries enacting further restrictions on Russia.

He says that Russian supply being cut off or limited might boost the price of De Beers rough, but he doesn’t think it will be particularly healthy for the market.

“Artificial supply shortages aren’t necessarily good for anybody,” Cleaver says. “We want to sell into sustainable growth.

“I can only speak for De Beers. We will continue to price rough in accordance with our view of demand, and what we think the polished price of that rough will be when it gets converted to polished.”

He notes that, with COVID-19 receding, De Beers plans to recommit to diamond exploration.

“We slowed down exploration spending in the COVID years and are ramping that up again,” he says. “We are in the process of finalizing a contract in Angola with the government to go back and let it explore. That’s not an easy place but clearly a place where you might find a large deposit, and we have some quite promising exploration in the main places we explore, which are Canada, Botswana, and South Africa.”

Asked for a message for the market, he urged the industry to “think back to 18 months ago, how dire it was, and think back to how it is now. People in the diamond industry sometimes have short memories. We should remember we’ve been through tough times. We are in a much healthier place, and while we live in a world that’s quite cyclical, I think the fundamentals are good for us.”

The news came as De Beers posted strong financial results. Total revenue increased in 2021 to $5.6 billion, up from $3.4 billion in 2020. Underlying EBITDA increased to $1 billion, from $417 million the prior year.

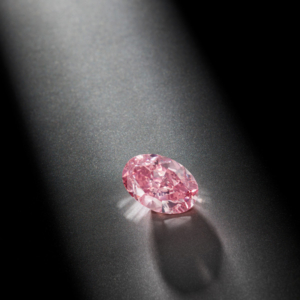

(Photo courtesy of De Beers)

Follow JCK on Instagram: @jckmagazineFollow JCK on Twitter: @jckmagazine

Follow JCK on Facebook: @jckmagazine